Limited Companies

A private limited company is one of the ways that you can structure a business and it is often the most tax efficient option. This type of company exists in its own right which means that the business finances are kept separate from the personal finances of the company owners. Yes the importance here is that any liability is limited to the company and any personal assets belonging to the owners are not put at risk, if the company run into financial difficulty.

Must have:

The company must have at least one director who is over 16 years old. It must be registered with Companies House and its registered office must be based in the UK. Annual accounts and an annual return must be filed at Companies House each year, on time or the director/s may be penalised.

Registering a new company

Before you can register a new company you need to decide on a company name and check if it is available. We can help you with this and advise you on the best structure for business. We offer a same day business start-up service for a setup fee of £60 plus VAT and Company Registered Address service for £120 plus VAT.

Working through a limited company offers a number of benefits, including:

-

Higher take-home pay

-

Claim on a wide range of business expenses

-

Greater opportunity for tax planning

-

Limited liability which protects personal assets if the company run into financial difficulties

-

Ownership can be divided up through the division of shares

-

Added confidence in suppliers and creditors

Directors and their responsibilities

Directors are responsible for making sure that the financial accounts of the company are accurate and that all statutory filing obligations are being met. They are also responsible for notifying Companies House of any changes in the structure and management of the business.

Company directors are normally required to complete a Self Assessment tax return each year.

The reward from the company will usually be in the form of a mixture of salary and dividends. It is important to structure these payments correctly and in the most tax efficient way in order to minimise the amount of taxes you need to pay, both as a business and personally.

What is a registered company’s address?

The location and registration address of the company is the official address, which is indicated in the Companies House and is used in the registries of official bodies. It is mandatory for any type of company, but should not coincide with the actual address or the location address or place of business of the legal entity.

The legal entity

The address of the legal entity is the first step to creating a legal entity. The registration address must be provided to the newly created legal entity in all cases. Registration of a legal entity is possible in all premises, i.e. residential, commercial and other. The purchase of the registration address is relevant for those who wish to create a legal entity as soon as possible, as well as for those who do not own the premises or simply do not wish to register the legal entity in their premises.

Buying an address

Buying an address of registration of a legal entity is also relevant for existing companies that simply want to change the address of registration of a legal entity. You also need to change the address of the legal entity, if you acquired the legal entity’s address during registration, and the legal entity’s address has already expired.

Why it is beneficiary to use our legal address?

- We are based in the business center, so all your correspondence will be successfully delivered

- At your request, all received correspondence can be forward to you by e-mail or by any other method agreed in advance

- All original received correspondence is stored in your company folder

- The address of your company will not coincide with your home address, which will ensure you greater privacy

- Everything you need for your company will be in one place

Closure of the Company

If, for any reason, your business is not active and you want to close it, keep in mind that it is necessary to prepare and submit all required financial reports, as well as to close financial liabilities to the HM Revenue and Customs and other creditors.

After you have filed application for closure, the Companies House will publish a notice on the closure of your company in the local The Gazette. If nobody objects, the company will be struck off the register once the 2 months mentioned in the notice has passed. A second notice will be published in the Gazette – this will mean the company won’t legally exist anymore (it will have been ‘dissolved’).

Restoration of dissolved company

If your company was dissolved due to the late reporting company legal status can be restored.

You can apply for administrative restoration if:

- You were a director or shareholder of a company

- The company has been dissolved in the last 6 years

- The company was active at the time of closure. Otherwise, you will need to obtain court permission to restore the company.

The Government fee for restoration starts at £164, Government fee amount depending on the number of late reports.

After restoring a closed company you will be allowed to continue running the business and use your bank account.

Bookkeeping & Accounting services

TaxDot UK provides an all-inclusive accounting service which will ensure that your accounts are kept up to date and you continue to meet all the statutory filing obligations involved with having your own business.

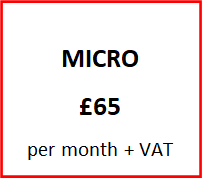

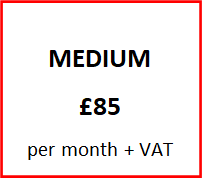

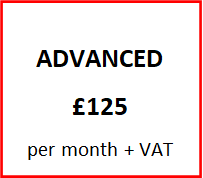

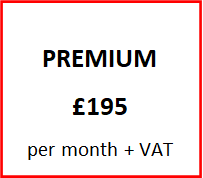

Our accounting fees for limited companies depend on whether or not the business is VAT, PAYE, CIS registered.

Whatever size business you have we have a monthly package to suit your needs!